October 14, 2024

SACRAMENTO, Calif. – Small nonfarm businesses in five Oklahoma counties and neighboring counties in Texas are now eligible to apply for low interest federal disaster loans from the U.S. Small Business Administration, announced Francisco Sánchez Jr., associate administrator for the Office of Disaster Recovery and Resilience at the Small Business Administration. These loans offset economic losses because of reduced revenues caused by drought in the following primary county that began Aug. 6.

Primary Oklahoma counties: Roger Mills;

Neighboring Oklahoma counties: Beckham, Custer, Dewey and Ellis;

Neighboring Texas counties: Hemphill and Wheeler.

When farmers face crop losses and a disaster is declared by the Secretary of Agriculture, SBA working capital loans become a lifeline for eligible small businesses. “These loans are the backbone that helps rural communities bounce back and thrive after a disaster strikes,” Sánchez said.

“SBA eligibility covers both the economic impacts on businesses dependent on farmers and ranchers that have suffered agricultural production losses caused by the disaster and businesses directly impacted by the disaster,” Sánchez continued.

Small nonfarm businesses, small agricultural cooperatives, small businesses engaged in aquaculture and most private nonprofit organizations of any size may qualify for Economic Injury Disaster Loans of up to $2 million to help meet financial obligations and operating expenses which could have been met had the disaster not occurred.

“Eligibility for these loans is based on the financial impact of the disaster only and not on any actual property damage. These loans have an interest rate of 4 percent for businesses and 3.25 percent for private nonprofit organizations, a maximum term of 30 years and are available to small businesses and most private nonprofits without the financial ability to offset the adverse impact without hardship,” Sánchez added.

Interest does not begin to accrue until 12 months from the date of the initial disaster loan disbursement. SBA disaster loan repayment begins 12 months from the date of the first disbursement.

By law, SBA makes Economic Injury Disaster Loans available when the U.S. Secretary of Agriculture designates an agricultural disaster. The Secretary declared this disaster on Oct. 1.

Businesses primarily engaged in farming or ranching are not eligible for SBA disaster assistance. Agricultural enterprises should contact the Farm Services Agency about the U.S. Department of Agriculture assistance made available by the Secretary’s declaration. However, nurseries are eligible for SBA disaster assistance in drought disasters.

Applicants may apply online and receive additional disaster assistance information at SBA.gov/disaster. Applicants may also call SBA’s Customer Service Center at (800) 659-2955 or email disastercustomerservice@sba.gov for more information on SBA disaster assistance. For people who are deaf, hard of hearing, or have a speech disability, please dial 7-1-1 to access telecommunications relay services.

The deadline to apply for economic injury is June 2, 2025.

Copyright 2024 Paragon Communications. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed without permission.

Lucas Statement on the Passing of President Jimmy Carter

Yukon, OK – Congressman Frank Lucas (OK-03) released the following statement on the passing of former President Jimmy Carter: “America has lost a faithful and selfless public servant. While he faced a number of political challenges throughout

Fatal Crash Claims One Life, Injures Another North of Arapaho

A tragic collision early Tuesday morning left one person dead and another injured on US-183 near E 860 Rd, approximately 13 miles north of Arapaho in Custer County. The crash occurred at approximately 12:06 a.m. and involved

Fatal Crash on US Highway 83 Near Shamrock Claims One Life

A two-vehicle collision on US Highway 83, approximately six miles north of Shamrock, Texas, resulted in the death of a Kansas man. The crash occurred on December 17, 2024, at 1:30 p.m. According to authorities, the crash

Tragic Collision Claims Three Lives Near Lone Wolf

A devastating collision on Monday claimed three lives and left a young child injured. The accident occurred around 6:02 PM on OK-44 and E 1440 Road, approximately four miles south of Lone Wolf. The crash involved a

Former Elk City Ag Teacher Arrested for Alleged Felony Embezzlement

Current Clinton Public Schools ag teacher Rick Dillinger is facing alleged felony embezzlement charges after being arrested this weekend, according to the Elk City Police Department. Dillinger, who previously was the ag teacher for Elk City Public

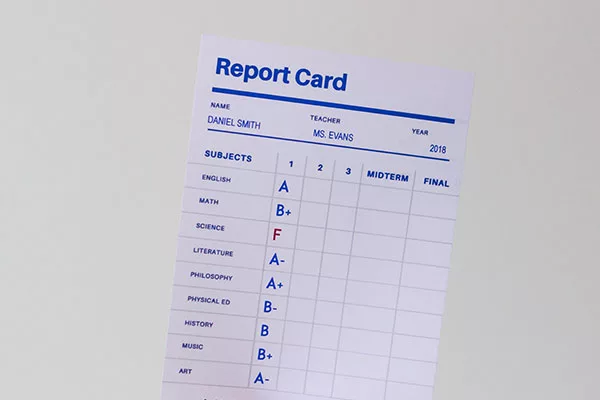

2024 Oklahoma School Report Cards Released: Western Oklahoma Schools See Mixed Results

The Oklahoma State Department of Education released the 2024 Oklahoma School Report Cards last week, revealing a wide range of performance grades for schools in western Oklahoma. The report cards measure academic achievement, growth, attendance, and other

Elk City Homemakers Donate Over 50 Stuffed Animals to GPRMC for Pediatric Patients

GPRMC Press Release The Elk City Homemakers recently donated over 50 stuffed animals to Great Plains Regional Medical Center (GPRMC) to bring comfort to pediatric patients. This generous gesture reflects the group’s commitment to supporting the local

Semi-Truck Crash Shuts Down I-40 Eastbound Lanes Near Erick

A single-vehicle collision involving a semi-truck temporarily shut down the eastbound lanes of I-40 near the 11-mile marker in Beckham County on Thursday, December 19, 2024. The accident occurred at 11:11 a.m., approximately four miles east of

SWODA Receives Opioid Abatement Funds to Expand Life-Saving Resources in Western Oklahoma

The Oklahoma Opioid Abatement Board has awarded funding to the South Western Oklahoma Development Authority (SWODA) to combat the ongoing opioid crisis. According to a press release, the funds aim to expand resources and services to save

Elk City Man Arrested for Meth Trafficking, Faces Up to 20 Years in Prison

An Elk City man is being held in the Beckham County Detention Center on a $40,000 bond after being charged with trafficking methamphetamine and destroying evidence. If convicted, he faces up to 20 years in prison. The

Indiana Man Arrested in Beckham County After High-Speed Chase

An Indiana man was recently arrested in Beckham County following a high-speed pursuit. According to Beckham County Sheriff Derek Manning, 21-year-old Arthur James Mhoon Jr. of Fort Wayne, Indiana, was arrested on December 18 after county employees

Clinton Woman Charged with Assaulting Custer County Deputy

A Clinton woman, 35-year-old Alicia Ruth Smith, also known as Alicia Ruth Dunn, faces felony and misdemeanor charges following an incident involving a Custer County Deputy on December 13, 2024. According to court records, Smith has been

Man in Critical Condition After Car Crashes into Pond in Elk City

A single-vehicle accident in Elk City early Sunday morning, where a car crashed into a pond, remains under investigation. According to Elk City Fire Chief Kyle Chervenka, the accident sent an unidentified man to an Oklahoma City

15-Year-Old Dies in Rollover Accident North of Sayre

A tragic accident claimed the life of a 15-year-old Sayre resident on Sunday, December 22, 2024. The fatal crash occurred at approximately 7:57 PM on N 1900 Rd and E 1120 Rd, about four miles north of

Registered Sex Offender Arrested in Elk City for Violating Residency Laws and Drug Possession

A registered sex offender, Donald Joseph Smith, was arrested on December 2, 2024, after authorities discovered he was residing in violation of Oklahoma residency laws. Smith, 43, was also found in possession of drug paraphernalia during the

SWOSU Hosts Reception in Honor of Piano Benefactors

The Southwestern Oklahoma State University (SWOSU) Department of Music recently celebrated those who have contributed to the success of the SWOSU Piano Campaign with a donor recognition event at the Oklahoma City Museum of Art (OKCMOA.) The

Taylor Elected to Oklahoma Farm Bureau State Board at Annual Meeting

Oklahoma Farm Bureau members selected two new state board members during the organization’s 83rd annual meeting in Oklahoma City. Jimmy Taylor, from Roger Mills County, was chosen as the District 2 director. He will serve a three-year

Archer Named Chair of House Energy Committee as Speaker-Elect Kyle Hilbert Announces Restructuring

House Speaker-Elect Kyle Hilbert has unveiled a new committee structure designed to improve the deliberation and vetting process for proposed legislation. The reorganization introduces a two-tiered structure of committees and oversight committees, creating opportunities for more thorough

SWOSU Hosts Chancellor & Speaker-Elect, Honors Sammons & Robinson

Southwestern Oklahoma State University (SWOSU) recently hosted a luncheon featuring Oklahoma State Regents for Higher Education (OSRHE) Chancellor Sean Burrage and Oklahoma House of Representatives Speaker-elect Kyle Hilbert. The luncheon was held at SWOSU’s Pioneer Event Center

Shamrock Native Promoted to Texas Ranger

Matthew Ferguson of Shamrock, Texas has been promoted to the Texas Rangers Division. Previously serving as a Highway Patrol Sergeant in Pampa, Ferguson now becomes part of the Texas Department of Public Safety’s primary investigative branch. The

Man Formally Charged After High-Speed Chase Following Stolen Vehicle Crash

The man accused of leading multiple agencies on a high-speed pursuit last month has formally been charged. A Granite, Oklahoma man, Samuel Herman Pence, 24, was taken into custody on November 15th, 2024, after a high-speed chase

Lucas Passed Over for Top House Financial Services Role

Oklahoma Congressman Frank Lucas of Cheyenne will not be the top Republican on the House Financial Services Committee, which oversees Wall Street, the Federal Reserve, and cryptocurrency. The committee’s decisions regarding banks and financial institutions have significant

SWOSU Nursing Department Offers a JumpStart Application Option

The Department of Nursing at Southwestern Oklahoma State University (SWOSU) is thrilled to unveil innovative new pathways designed to streamline nursing school admission. Jump Start Application for Pre-Nursing Majors First, the Jump Start Application process provides early

Man Released on $50K Bond After Trafficking 120 Pounds of Marijuana in Beckham County

A 41-year-old man, Mahdi Ishmael J. Alston, was released from the Beckham County Detention Center on a $50,000 bond after being charged with trafficking illegal marijuana. The investigation began on December 8 when an Oklahoma Bureau of

Clinton Man Arrested for Liquor Store Burglary After Security Footage Links Him to Crime

On December 7, Ira Lamborn, 22, of Clinton, was arrested and charged with second-degree burglary after allegedly breaking into a local liquor store. According to a probable cause affidavit by the Clinton Police Department, the incident occurred